Physical Loss or Damage.

A common insurance company tactic in response to insurance claims arising out of the Covid 19 pandemic has been to argue that all policies regardless of how worded require that the insured’s property be damaged to recover lost business income. Studio 417, Inc., a recent decision from the Western District of Missouri, correctly rejects that one-size-fits-all analysis.

The Insurance Company Mantra. Regardless of the wording of any given policy, insurance companies frequently repeat the mantra that business income losses cannot be recovered absent physical damage to the insured’s property. Insurance companies routinely invoke this mantra even when coverage is triggered, in whole or in part, by “loss,” “physical loss,” “loss or damage,” or “physical loss or damage.” In some instances, insurance companies subtly disguise the weakness inherent in their position by alternately describing the alleged “physical damage” pre-requisite as a “tangible,” “permanent,” or “physical alteration” of the property. In so doing, they direly warn that such a requirement must be imposed regardless of the language used; otherwise, coverage would potentially exist “whenever a business suffers economic harm.”

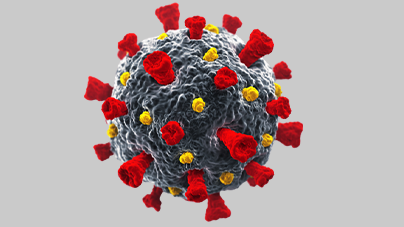

The Mantra as Applied to Covid 19

In the case of Covid19 losses, insurance companies have taken the position that no such physical damage can be shown either because the insured’s loss arose from its inability to use its property due to a closure order (not property damage) or because the Covid 19 virus even if present “hurts people, not property.” Contrary to insurance company scare tactics, however, these circumstances can easily be distinguished from economic harm due to mismanagement, competition or other losses that do not arise from an event that affects an insured’s ability to use its property.

Studio 417, Inc. The Court’s opinion in Studio 417, Inc. offers a good example as to why that one-size-fits-all approach to policy interpretation makes no sense. In that case, the policy in question provided coverage for “accidental physical loss or accidental physical damage.” Under well-settled rules of policy interpretation, this disjunctive wording necessarily means that either “loss” or “damage” will suffice and that “loss” is distinct from “damage.” As the Court rightly pointed out, Defendants’ argument—that “physical loss” requires actual, tangible, permanent, physical alteration of property—improperly treats the phrases physical loss and physical damage as if they have the same meaning.

Physical loss, of course, may reasonably be interpreted to include loss of use, such as occurs when a government prohibits use or when the presence of a virus makes a property unsafe or unusable. That such loss of use is somehow not physical, but intangible, defies logic. Property that cannot be physically used for whatever reason is still a physical loss. Likewise, it makes no sense to argue that loss means the impact must be permanent. If that were so, coverage could not exist, as it commonly does, for the temporary “loss” of business income.

A Second Opinion. If your Covid 19 insurance claim has been denied or you’ve been told that your policy will not cover your loss due to the absence of property damage, it may be worth your while to get a second opinion. Please call the firm at 713 423 6772 and get the second opinion your business deserves.